Is the Bull Back on?

Hello all,

I must say, after a brief hiatus from producing my usual monthly market outlooks, it feels good to be writing again.

Perhaps you may have noticed but I have not produced a market outlook since May. My family and I took advantage of the warmer weather to fill our weekends with some well-needed family fun.

Nevertheless, this little break reminded me of a famous adage Wall Street tosses around from time to time.

“Sell in May and go away”

Although we did get away in May, I did more buying than selling.

It is important to note that this adage does hold significant statistical relevance over the 230+ year history of the US Stock market.

May through October is historically the weakest period of the year in terms of stock market performance.

According to a study from Fidelity, May to October has produced a paltry 2% average return, whereas November to April has returned 7% average over the same time frame.

Perhaps the warmer weather gets money managers and investors off the computer and out spending quality time with their families.

Regardless, statistical relevance does not mean the historical data is easy to predict.

Take this year for example. Equity markets have rallied handsomely since May. It's shaped up to be more of a “buy in May and stay” market, for the time being.

Of course, October is not here yet so the relevance is still in question for 2023. At this point, a more prudent question needs exploration.

Are we experiencing one of the longest bear market rallies in history, or is the bull market back on?

Although well under the previous highs, there is no doubt that the market is currently experiencing a sentiment-driven momentum rally.

Much of this can be attributed to the prediction that a strong labor market, strong (although slowing) consumer spending, and an Artificial Intelligence (AI) corporate profit boost are a strong catalyst for a "soft" (maybe even canceled) economic landing.

In my opinion, this is fairly speculative at this juncture, as the world economy and markets sit on a foundation of juxtaposed data and forecasts.

Given we are in the early innings of quarterly data, let's take a look at areas that have the potential to derail the current market rally.

Earnings Recession

As we make our way to the start of earnings season some institutions believe S&P 500 corporate earnings could decline substantially.

According to Factset, the second quarter of 2023 earnings estimates project a decline of -7.2%. Which, if projections become reality, will be the steepest decline in earnings since Q2 of 2020.

Of course, if earnings come in higher than estimates, markets may get a boost through the quarter as what was feared was a false reality.

But, as investors we value companies based on future earnings and growth, a decline in earnings at, or below, estimates may result in a correction to the perceived fair value in stock prices as valuations, already historically high, are seen as a fundamental blunder.

Tighter Lending Conditions

Another area of concern is the continued tightening of financial conditions. As we are all aware the Fed fund rate - the rate that banks lend to each other to meet their overnight capital obligations - has risen from .25% to 5.25% since March of 2022.

This was done to combat the rise in inflation. Raising rates makes the cost of borrowing rise, which in turn makes securing loans more difficult for individuals and businesses.

At the same time, banks have increased the standards needed to secure said loans.

As the chart below suggests, financial conditions have been slowly tightening. If this trend continues and tightens further, a recession albeit thought to be "delayed", or even "canceled" as some may suggest, may certainly still be lurking.

Source: fred.stlouisfed.org

NOTE: In the chart above, the shaded areas represent past recessions. The more negative (below zero) the number the more "loose" conditions are.Representing it is easier to obtain credit and lending and the more positive the number the more tight, or more difficult it is to get credit or lending.

Current market direction thoughts

The current market rally has been strong; however, what is most interesting, up to this point, is the depth of the rally.

It was not broad, in terms of participation. Until now, much of the market returns have been sustained by a relatively small subset of companies.

In the graphic below, we see that the top ten companies by weight in the S&P 500 (SPY) and the Nasdaq 100 (QQQ) have made up roughly 30% and 60% of the index's gains, respectively.

Source: Nasdaq Dorsey Wright

There is no statistical data to say that an overweighting of gains produced by a small subset of companies in an index has any ability to forecast future direction of the market, however, the weightings of the top ten holdings, being quite large, will have an effect on the direction of the indexes as a whole. Meaning, if they fall/rise the indexes will fall/rise with them.

That is, unless a more broad rally were to take shape, which may actually be the case looking forward.

Recently, the Russell 2000 (VTWO), 2000 of the smallest companies in the US Stock market, started showing some motivation to break to the upside out of its recent trading band. Although not definitive, this may be the signaling the start of the current rally broadening out (see chart below).

Source: finviz.com

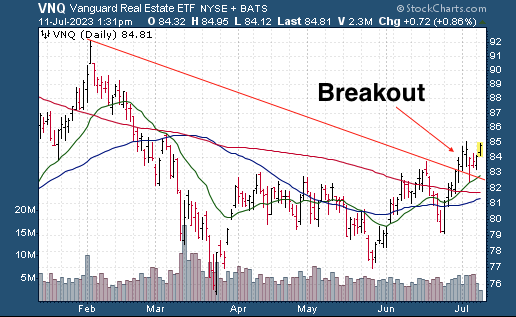

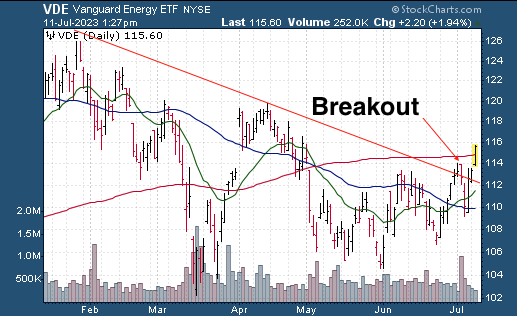

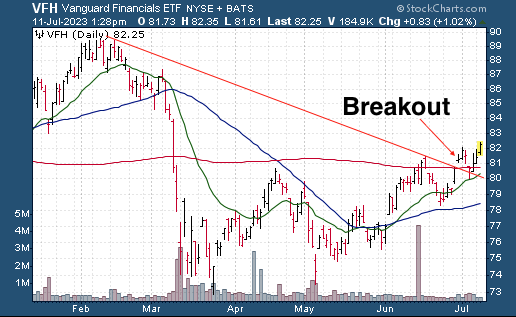

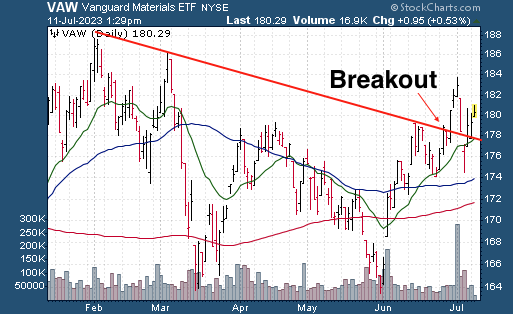

And there are more examples. Take a look at the charts for REIT's, Material, Energy, and Financials.

As a practitioner of technical analysis, seeing the potential for a broader rally is a good sign in terms of the longer term stability of the current market rally.

This does not mean the large weighted companies mentioned above cannot fall in price pushing indexes lower; however, a more broad participation of companies and sectors have potential to dampen any pullback if a more broad rally continues in its current trend.

If not, this is all just a long bear market rally and not a restart of the bull market.

Conclusion

There are many positive developments taking place in the capital markets keeping market participants positive for the future outlook. Yet, at the same time there is equally enough negative economic data to keep institutions more cautious as they deem current valuations extended.

I suspect a pullback to come sometime over this quarter as I too believe valuations are extended to some respect, although, the size and scope are in question.

If earnings come in better than feared, broader market participation continues, and economic data shifts to the Fed's liking we may see a light (or no) correction in asset prices. Yet, if the opposite is true a deeper correction may come.

Nevertheless, if you're a client, I am always watching and assessing to make changes if/when needed.

In the mean time, I hope you all get to "go away" this summer and enjoy some well needed time with your families!

“A market downturn doesn’t bother us. It is an opportunity to increase our ownership of great companies with great management at good prices.” ― Warren Buffett

Thank you for reading,

James Anadon