Stop Talking About Stocks.

Yes! We are so close I can taste it.

Nope, I am not talking about a Fed pivot, inflation slowing, treasury market liquidity trouble, the US Dollar weakening, better earnings guidance, or a market bottom (Keep reading for that stuff).

I am talking about TURKEY!

(Breathes deeply...) The nostalgia of tryptophan-induced food comas and being surrounded by friends and family.

We literally can't wait. As I write this, my wife is brushing up on her baking skills and our daughter, Olivia, is eager to assist - at almost three years old, this is the first year that these activities captivate her.

But considering my profession, Thanksgiving gatherings this year will be full of eager ears to hear my thoughts on the future direction of the capital markets.

And because these newsletters serve as the sounding board of my thought and analysis, I will always shamelessly direct everyone to them.

But boy, is there a lot to talk about.

I mean, when was the last time we were in an environment where the most bullish position a company can take is to lay off employees?

Yeah, I'm looking at you Meta, and Google.

It's All About Bonds.

Honestly, I don't want to talk about stocks this Thanksgiving.

Not because of the brutal year we have had, but because I believe that the fragile state of the treasury debt market should be the real topic of discussion.

Debt rules the world. Without it, companies do not grow... We do not grow. And when it does not function properly, it has the potential to throw some serious punches at all asset prices.

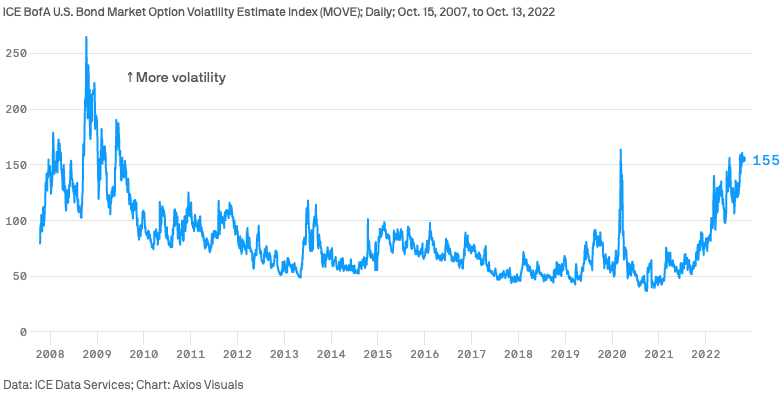

Take a look at the MOVE index (below). It tracks volatility in the bond market and it's at its highest level since 2020.

Treasury secretary, Janette Yellen, has taken notice - stating that she is "worried about a loss of adequate liquidity in the [treasury] market” and is actively looking for ways to keep the lid on tight.

A continued elevation of bond market volatility in the face of a Fed tightening cycle has the potential for more pressure, from an index perspective, to keep stocks on a southern trajectory.

But we know things are not great... So let's look for a silver lining together.

The silver lining

For the last 41 years, investors have been fighting with rates moving to the downside. This eventually forced bond investors to raise their acceptable level of risk needed to generate the yield they required by pushing money into more equity-like investments.

But earlier this year, rates finally broke out of their 41-year slide (chart below).

Source: TD Ameritrade Think Pipes Chart - 10 yr. Treasury date 1996 to 2022

This breakout is a potential signal that the future of interest rates may look much different from the last 41 years. Which may affect the way we invest moving forward.

This reality, although generating short-term volatility for the equity and debt markets, is currently developing a gift to investors in search of yield. As rates potentially move higher in the medium to long term, being a debt investor may start to look more attractive than recent history has reflected.

Because of the way individual debt instruments function and despite the presumed volatility in the debt market, individual bonds (not bond funds or ETFs), may need a double take from some investors.

If you are a client, you know we have held a significant amount of cash for the better part of a year. Which, until indicators suggest otherwise, will continue. However, as the situation develops and as your personal asset allocation deems, adding some short-term individual bond allocations may be on the horizon.

If you are not a client and would like more information on the topic above, please contact us using the information below or on our website

Conclusion

I know the last few years have been interesting to navigate, but let this time of year serve as a purposeful way to remind us to give thanks, take stock on what is important, and be charitable.

And although there is so much good on the horizon and so much to be grateful for, there may be some within our communities who may need to be reminded that the future is bright. Because we're better together.

Let's pass on some joy this year.

“There are only two ways to live your life. One is as though nothing is a miracle. The other is as though everything is a miracle.” — Albert Einstein

Thank you for reading,

James Anadon