Did the Market Just Bottom?

First, before we really dig in, can we agree on something?

There is only one investor, no longer living among us, that time and time again successfully called and navigated every top and bottom pretty much perfectly. His name?... Bernie Madoff. Ba dum tss!

And we all know how that story goes.

The point is, calling a bottom or top with any accuracy is nearly impossible. Save for the random lucky guess.

That said, the prospect that inflation may have peaked helped fuel a serious rally over the last several weeks as investors weigh whether or not a Fed policy shift might be on the horizon.

Although a little relief in the equity markets is welcome, there is much reason for caution as this recent rally is potentially nothing more than a bear market rally.

In light of the recent rebound and the shear volume of market calls lately, I wanted to offer my thoughts on what I will currently call the great debate.

Bottom or Bear Market Rally?

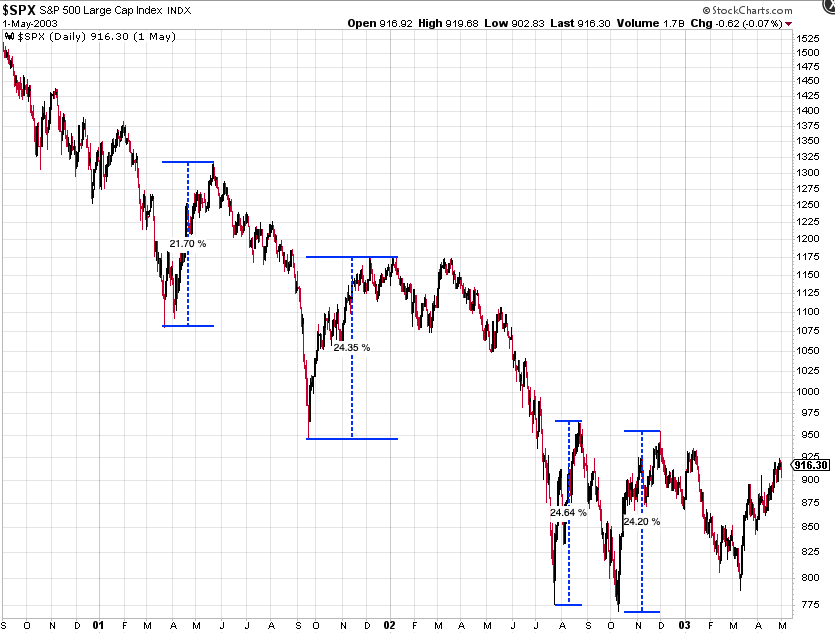

Relief rallies such as this can be a confidence booster, especially when you want them to happen (beware of confirmation bias). But bear market rallies are fairly normal. In fact, in the dot com bubble the S&P 500 saw four bear market rallies of more than 20% before finding a bottom (reference chart). In the 2008 GFC, there were two large bear market rallies of 18.5% and 24% during the later stages of the decline.

In the past, tough economic periods have been overshadowed by easy fiscal and monetary policy, however, believing the fed will end their tightening policy because of a slightly lower inflationary gain may be a bit pre-mature. The pandemic era helicopter money is not coming...consumer credit debt is rising well above its average and rents may continue to rise at their fastest pace ever.

To me this means inflation is still in the picture. Perhaps the pace of inflationary rate of change slows, but much of the recent price hikes may prove to stick around reminding the current rally participants that the fed is sticking to tightening, at least for a little while.

Nevertheless, I am keeping an open mind on both sides of the table. I am willing to entertain the idea that we have hit a market bottom...and if that is the case we should expect the market to put in a higher low before continuing higher.

Conclusion

Per our indicators, the current rally is over extended. Many of the companies we follow have hit overbought territory and we should expect the rally to fade over the next few weeks. This will offer opportunity if the bottom is truly in, but if the market's current clear path forward starts to muddy...we may see the market much lower pretty soon.

For now, I am cautious. I have taken advantage of this rally to trim position and look for future opportunities. Given the headline driven volatility as of late I believe that patience is key right now. We need to keep an eye on our indicators and give the market some time.

"Time is the wisest counselor of all." – Pericles.

Thank you for reading,

James Anadon

Investment Advisory Services offered through Caitlin John • 1024 E. Grand River Ave., Brighton, MI 48116 • (810) 355-1325 Office • (810) 227-2558 Fax • Caitlin John and Olivia Wealth Management are independently owned and operated. Olivia Wealth Management does not offer legal or tax advice. This material is not intended to replace the advice of a qualified tax advisor or attorney. Please consult legal or tax professionals for specific information regarding your individual situation.The information, data, and opinions contained herein this communication are provided solely for informational purposes only. They are not warranted to be correct, complete, or accurate. To the extent permitted by law, Olivia Wealth Management and Caitlin John do not accept any liability arising from the use of this communication. You should not assume that any information, data, or opinions contained herein serves as the receipt of, or a substitute for, personalized investment advice from any other investment professional. Past performance is not an indication of future results and actual results may vary. Investing carriers an inherent element of risk, including the risk of losing invested principal.